By Stephanie Cyca for Industry West Magazine

The industries of banking and insurance have a longstanding, western ideology-based tradition. When you think of banking, insurance, and financial institutions there is likely a set image in your mind as to what banking and insurance are and are not. But as Canada and society move forward there are more and more challenges to traditional approaches to long set industry standards.

The First Nations Bank of Canada (FNBC) and TIPI-IMI Insurance Partners are two companies that have established themselves as Indigenous banking and finance institutions that serve their communities and bring about the unique perspectives and understanding that are missing from the world of finance.

FNBC began its journey in the Canadian financial landscape in 1996. There were two main driving forces that led to the bank’s opening, first, the need for a bank to serve Indigenous clients, especially as the Indigenous communities started to experience their own economic growth. The second factor was identifying that while these communities were starting to experience growth, there were also issues that they were facing—issues that were not being addressed by the traditional banking and finance worlds.

The founders of FNBC had a vision to develop a federally-chartered bank serving Indigenous and non-Indigenous people throughout Canada. The bank was conceived and developed by Indigenous People, for Indigenous People as an important step toward Indigenous economic self-sufficiency. “In 1996, we founded First Nations Bank of Canada to bring both financial and social returns to Indigenous People and communities who were under-served by existing financial services options,” explains Keith Martell, president and CEO, First Nations Bank of Canada and FNB Trust.

The challenges that Indigenous people face are sometimes obvious, such as the Indian Act setting out that reserve land is owned by the Crown, which prevents banks and lending institutions from recognizing it as security. Other barriers do not relate to laws or legalities, but to physical locations, distance, and diversity. Remote northern locations are tricky to access, sometimes costing plane rides of $800 or more, and mainstream financial institutions either cannot, or do not want to, deal with accommodations. Finally, until more recently, there hasn’t been a lot of diversity and inclusion in the banking and insurance sectors.

Today, most of the customers of the FNBC are Indigenous, 60 to 75 per cent of staff, and 89 per cent of shareholders are also Indigenous Peoples. “[We strive to provide a place that] makes people comfortable to do banking there,” explains Martell. And it’s not just the customers that they want to feel comfortable. This past March, FNBC was once again named one of Saskatchewan’s Top Employers by Mediacorp Canada Inc. for providing its employees with an exceptional place to work.

Operating to bridge the gap between traditional financial institutions and Indigenous culture is the basis, and one of the founding principles, of TIPI-IMI Insurance Partners. TIPI-IMI have been working towards not only creating accessible and flexible insurance coverage for their clients and customers, but working to become a part of these communities and understand the root causes of issues. By conducting business with a degree of care and understanding, they can not only shape policies that help their customers, but they have become a positive force in the communities they serve.

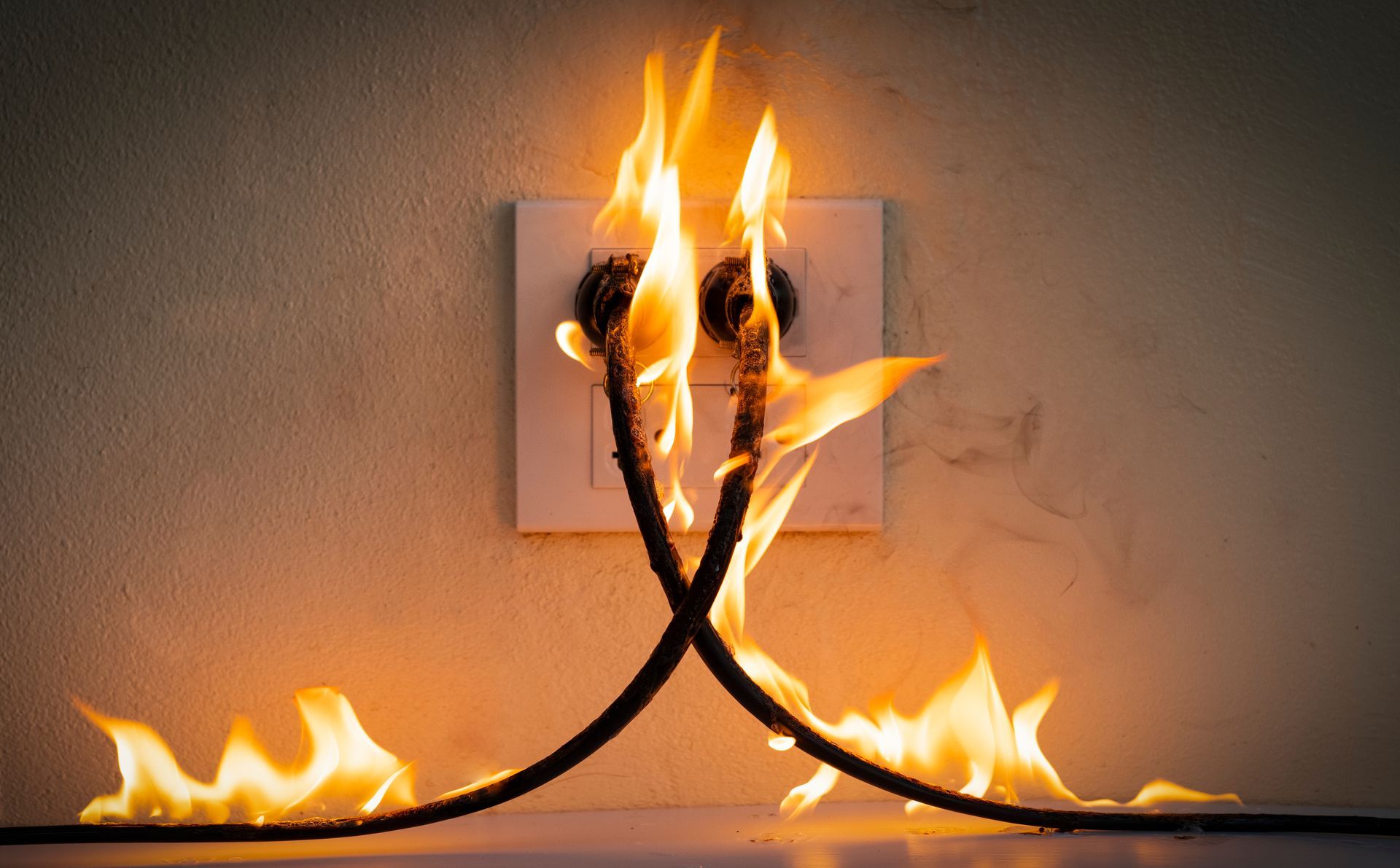

TIPI-IMI does not only offer insurance packages to their clients, they work to understand the communities individually and intimately, constantly striving to determine where they can be of the most assistance. This might be working to start programs to help identify and report areas in a community that lack proper fire protection, working to help alleviate housing shortages, or being a third-party go-between for communities and the government for things like grants and funding.

Nathan Ballantyne, CEO of TIPI-IMI, said, “[TIPI-IMI] wants to offer our services as a total community coverage and wrap our arms around our clients.” One of the biggest issues that Ballantyne identified and worked towards combating early on with TIPI-IMI was the concept of “economic leakage”. This is where a community has money or funding but must turn outside of the community for goods and services, thus leading to leakage from the local economy. If the community can put the funds back into circulation, growth will follow.

It was difficult work, Ballantyne noted, but he is grateful for those who walked with them, had the hard conversations, and worked to stop the economic leakage. And while TIPI-IMI had entered the financial field on the defensive, with all the work that has been done the tides are now beginning to turn.

“As an Indigenous company, it honestly feels that we have to work harder than a non-Indigenous company due to preconceptions and stigma,” said Ballantyne. He noted that there is a pressure to feel the need to prove themselves more than others, but that this pressure has also lit the fire that has driven TIPI-IMI to be as successful as they are today.

Janice Gladue, COO of TIPI-IMI, also spoke about the future of what can be done to help bring about better services and inclusion to Indigenous people. There is a lot of talk about Indigenizing the industry as of late, but Gladue questions this.

“Is this possible, or even the goal?” she asks. “The better question is: how do we influence?” Gladue posits. “Our goal should be using our values, not only as a company but as Indigenous individuals – protecting, being there for others in the community.”

Fundamentally the way business is conducted around the world is changing and moving forward in big ways. The global and Canadian economies are seeing driving changes. While there is much work still to be done, groups like First Nations Bank and TIPI-IMI are finding that they now have a place at the table. By being able to use their voices and raise concerns, there is now the potential help to shape the future of finance.